Chargeback Disputes

A chargeback occurs when a customer contacts their financial institution to contest a payment they either do not recognize or disagree with, seeking compensation on their card bill.

Fraud chargeback - This is the most common chargeback. The cardholder does not recognize a payment made with their card. It may be the result of a cloned card, a data leak, or some vulnerability that has breached the customer data.

Commercial disagreement - This type of chargeback has nothing to do with fraud. The cardholder acknowledges the purchase—they bought it and know it—but they were not satisfied for some reason. It may be related to delivery problems, product or service quality, or a failed refund request.

Friendly chargeback - This case is quite common. It happens when the owner of the card lends it to someone they know to buy an item, but the person takes advantage and buys other things as well. The card owner recognizes the buyer but not the additional purchases.

Processing error - The credit card transaction was processed more than once because of a processing error.

What is a chargeback dispute

A chargeback dispute occurs when a merchant challenges a chargeback initiated by a customer. This process allows the merchant to present evidence to the issuing bank to prove the validity of the transaction and contest the customer’s claim. Chargebacks are granted under consumer protection laws and follow card scheme rules, which define the procedures, reason codes, and documentation required for disputes.

How it works

Customer initiates a chargeback - The customer contacts their card issuer to contest a transaction, citing reasons such as fraud, dissatisfaction with the product or service, or processing errors.

Funds deducted from merchant's settlement - When the chargeback is initiated, the amount is temporarily deducted from the merchant's settlement to cover the disputed charge.

Merchant submits evidence - To dispute the chargeback, the merchant provides documentation proving the transaction was legitimate. Evidence may include delivery confirmations, communication records, and proof of customer consent.

Issuer reviews the evidence - The issuing bank evaluates the evidence submitted by the merchant to decide whether the chargeback is valid.

Outcome

- If the merchant wins the dispute, the funds are credited back to their settlement.

- If the dispute is unsuccessful, the chargeback remains, and the process is concluded.

Chargeback reasons

Chargeback reasons provide a clear explanation of why a dispute was initiated by the customer. Understanding these reasons helps merchants identify areas for operational improvement, detect fraudulent consumer behavior, and address potential vulnerabilities in their processes.

| Reason | Description |

|---|---|

| Unrecognized | The customer does not recognize the transaction. |

| Paid by other means | Double payments, or operational errors. |

| Processing error | Errors during payment processing. |

| Product not received | The customer did not receive the purchased item. |

| Overcharged | The charged amount was incorrect. |

| Product unacceptable | The item was different than expected. |

| Credit not processed | Refunds or credits not processed as expected. |

| Fraudulent | Unauthorized transactions due to data breaches or stolen cards. |

Reason codes

Not all reasons allow disputes

| Code | EBANX Description | Category | Group | Disputable |

|---|---|---|---|---|

| 4863/75 | Transaction not recognised | UNRECOGNIZED | Fraud | Yes |

| 4837/83 | Fraud (card-not-present)/No cardholder authorisation | FRAUDULENT | Fraud | Yes |

| 4850/57 | Installment dispute / Fraudulent Multiple Transactions | GENERAL | Fraud | Yes |

| 4853/53 | Not as described, defective merchandise or counterfeit | PRODUCT_UNACCEPTABLE | Commercial Disagreement | Yes |

| 4855/30 | Services not provided or merchandise not received | PRODUCT_NOT_RECEIVED | Commercial Disagreement | Yes |

| 4841/41 | Canceled/Non authorized Recurring Transaction | CREDIT_NOT_PROCESSED | Commercial Disagreement | Yes |

| 4860/85 | Credit not processed | CREDIT_NOT_PROCESSED | Commercial Disagreement | Yes |

| 4846/76 | Incorrect currency or transaction code | OVERCHARGED | Processing Error | No |

| 4808/77 | Non-matching account number/Authorisation related CBK | PROCESSING_ERROR | Processing Error | No |

| 4842/74 | Late presentment | PROCESSING_ERROR | Processing Error | No |

| 0000/73 | Expired card | GENERAL | Processing Error | No |

| 4834/82 | Duplicate processing | OVERCHARGED | Processing Error | No |

| 4831/86 | Paid by other means/ Transaction amount or account differs | PAID_BY_OTHER_MEANS | Processing Error | No |

| 4849/93 | Questionable merchant activity / Risk Identification Service | GENERAL | Other | No |

| 0000/79 | Retrieval request not received or illegible | GENERAL | CATB (MX only) | No |

| 0000/78 | Split transaction to avoid limit blockage | GENERAL | CATB (MX only) | No |

| 0000/00 | Reason code not available | GENERAL | Other | No |

| 2000/01 | Reason code not available | GENERAL | Other | No |

| 2000/02 | Reason code not available | GENERAL | Other | No |

| 4837/104 | Fraud (card-not-present)/No cardholder authorization | GENERAL | Fraud | Yes |

| 4853/135 | Not as described, defective merchandise or counterfeit | GENERAL | Commercial Disagreement | Yes |

| 4853/134 | Not as described, defective merchandise or counterfeit | GENERAL | Commercial Disagreement | Yes |

| 4853/133 | Not as described, defective merchandise or counterfeit | GENERAL | Commercial Disagreement | Yes |

| 4855/131 | Services not provided or merchandise not received | GENERAL | Commercial Disagreement | Yes |

| 4855/137 | Services not provided or merchandise not received | GENERAL | Commercial Disagreement | Yes |

| 4841/136 | Cancelled/Non authorized Recurring Transaction | GENERAL | Commercial Disagreement | Yes |

| 4841/132 | Cancelled/Non authorized Recurring Transaction | GENERAL | Commercial Disagreement | Yes |

| 4860/138 | Credit not processed | GENERAL | Processing Error | No |

| 4846/123 | Incorrect currency or transaction code | GENERAL | Processing Error | No |

| 4846/122 | Incorrect currency or transaction code | OVERCHARGED | Processing Error | No |

| 4808/127 | Non-matching account number/Authorisation related CBK | GENERAL | Processing Error | No |

| 4842/121 | Late presentment | PROCESSING_ERROR | Processing Error | No |

| 0000/113 | Expired card | GENERAL | Processing Error | No |

| 4834/126 | Duplicate processing | GENERAL | Processing Error | No |

| 4831/124 | Paid by other means/ Transaction amount or account differs | GENERAL | Processing Error | No |

| 4831/125 | Paid by other means/ Transaction amount or account differs | PAID_BY_OTHER_MEANS | Processing Error | No |

| 4849/105 | Questionable merchant activity / Risk Identification Service | GENERAL | Other | No |

| 0000/102 | Liability Shift Non-Counterfeit Fraud | GENERAL | Card Present Only | No |

| 0000/112 | Declined Authorization | GENERAL | Card Present Only | No |

| 0000/127 | Invalid data | PROCESSING_ERROR | Processing Error | No |

| 0000/138 | Original Credit Transaction Not Accepted (EUROPE ONLY) | CREDIT_NOT_PROCESSED | Commercial Disagreement | Yes |

| 0000/139 | Withdrawal at an ATM | PRODUCT_NOT_RECEIVED | Card Present Only | No |

| 0000/72 | The charge bears the signature of another person | GENERAL | Card Present Only | No |

| 4515/80 | Paid by other means/ Transaction amount or account differs | GENERAL | Processing Error | No |

| 4527/103 | Card-Present Environment/Condition | GENERAL | Card Present Only | No |

| 4750/00 | Car Rental Charge Non Qualified Or Unsubstantiated | GENERAL | Commercial Disagreement | Yes |

| 4801/00 | Cardholder Dispute | GENERAL | Cardholder Dispute | No |

| 4807/111 | Canceled Card Report | GENERAL | Authorization | No |

| 4808/113 | Declined Authorization | GENERAL | Authorization | No |

| 4808/57 | Instalment dispute / Fraudulent Multiple Transactions | GENERAL | Fraud | Yes |

| 4835/73 | Expired Card / Account | GENERAL | Authorization | No |

| 4840/00 | Fraudulent Processing of Transactions | GENERAL | Card Present Only | No |

| 4850/00 | Wrong number of Installment Billing | GENERAL | Processing Error | No |

| 4859/00 | ATM Dispute | GENERAL | Card Present Only | No |

| 4870/101 | Liability Shift Counterfeit Chip Fraud | GENERAL | Card Present Only | No |

| 4901/000 | Required Document Not Received to Support Second Presentment | GENERAL | Other | No |

| 4902/000 | Document Received was Illegible | GENERAL | Other | No |

| 4903/000 | Scanning Error - Unrelated Documents or Partial Scan | GENERAL | Other | No |

| 5002/000 | Required Document Not Received - Domestic | GENERAL | Other | No |

| 5003/000 | Required Document Not Received /Not recognized - Domestic | GENERAL | Other | No |

| 0100/10 | Found previous chargebacks registered | GENERAL | Fraud | Yes |

| 0100/11 | Found suspicious email formation | GENERAL | Fraud | Yes |

| 0100/12 | Found suspicious purchase attempts behavior | GENERAL | Fraud | Yes |

| 0100/13 | Found suspicious purchase history behavior | GENERAL | Fraud | Yes |

| 0200/14 | Found previous purchase using alternative payment method | GENERAL | Commercial Disagreement | Yes |

| 0200/15 | Found previous purchase using any credit card number for same merchant without refunds/chargebacks | GENERAL | Commercial Disagreement | Yes |

| 0200/16 | Found previous purchase using same credit card number for any merchant without refunds/chargebacks | GENERAL | Commercial Disagreement | Yes |

| 0300/17 | Fallback to Fraud Prevention manual review | GENERAL | Review | No |

| 0900/10 | EWallet Commercial Disagreement | GENERAL | Commercial Disagreement | Yes |

Providing dispute evidence

To comply with card scheme rules and ensure a higher success rate for disputes, specific technical requirements must be followed when submitting evidence. These requirements aim to standardize the analysis process across card schemes.

Technical specifications

- File format: PDF

- Paper size: A4

- Maximum pages: 8

- File size limit: 2MB

Providing detailed and accurate documentation is critical to increase the chances of a successful dispute. Note that the responsibility for submitting truthful and comprehensive information lies with the merchant, not EBANX.

Recommended support documentation

Below are examples of documentation that can strengthen your dispute case. Consider the specifics of your business and market when preparing evidence.

General documentation:

- Customer support history (e.g., email, WhatsApp conversations, or other communication records).

- Purchase and customer details (e.g., items purchased, customer name, product/service descriptions).

- Confirmation emails.

- Record of previous uncontested payments.

- Proof that the cardholder verified the account before the transaction.

- Proof of delivery (e.g., purchase tracking, service usage confirmation).

- Customer validation (e.g., SMS or email confirmation).

- Customer documents (if available).

- Electronic receipts.

- Delivery tickets.

- Email history.

- Customer purchase history.

- Screenshot or document showing accepted terms and conditions.

- Exchange and cancellation policy (e.g., product page policies).

Specific documentation:

- For goods:

- Description of the products, including the purchase and delivery dates.

- Delivery receipt signed by the carrier (e.g., DHL, UPS).

- Purchase tracking printouts.

- Communication confirming possession of goods by the cardholder.

- Explanation of delayed shipments, if applicable.

- For digital goods:

- Description of the digital products, including purchase and download dates.

- For services:

- Documentation proving the service was provided (e.g., confirmation emails, invoices).

- Start date of service usage.

- Proof of prior service usage by the cardholder.

- Record of previous uncontested payments.

- For goods:

Dispute process

Once evidence is submitted, EBANX will forward it to the acquirer, who will then send it to the issuing bank for review. The issuing bank will analyze the evidence and decide the final status of the dispute, which will reflect on your settlement.

By providing thorough, relevant, and accurate documentation, you can significantly improve the likelihood of a favorable outcome in chargeback disputes.

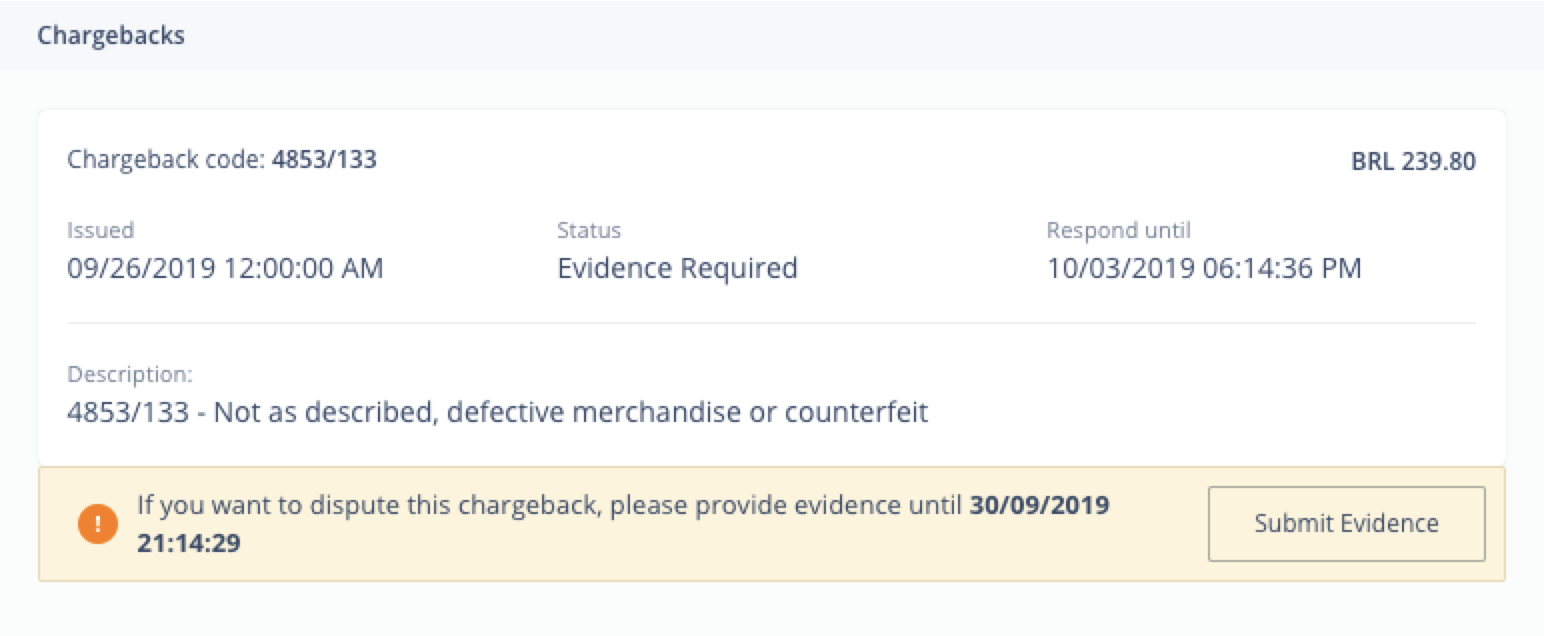

Managing disputes via EBANX dashboard

Once a dispute is initiated on the EBANX Dashboard, evidence will be required to proceed with the process.

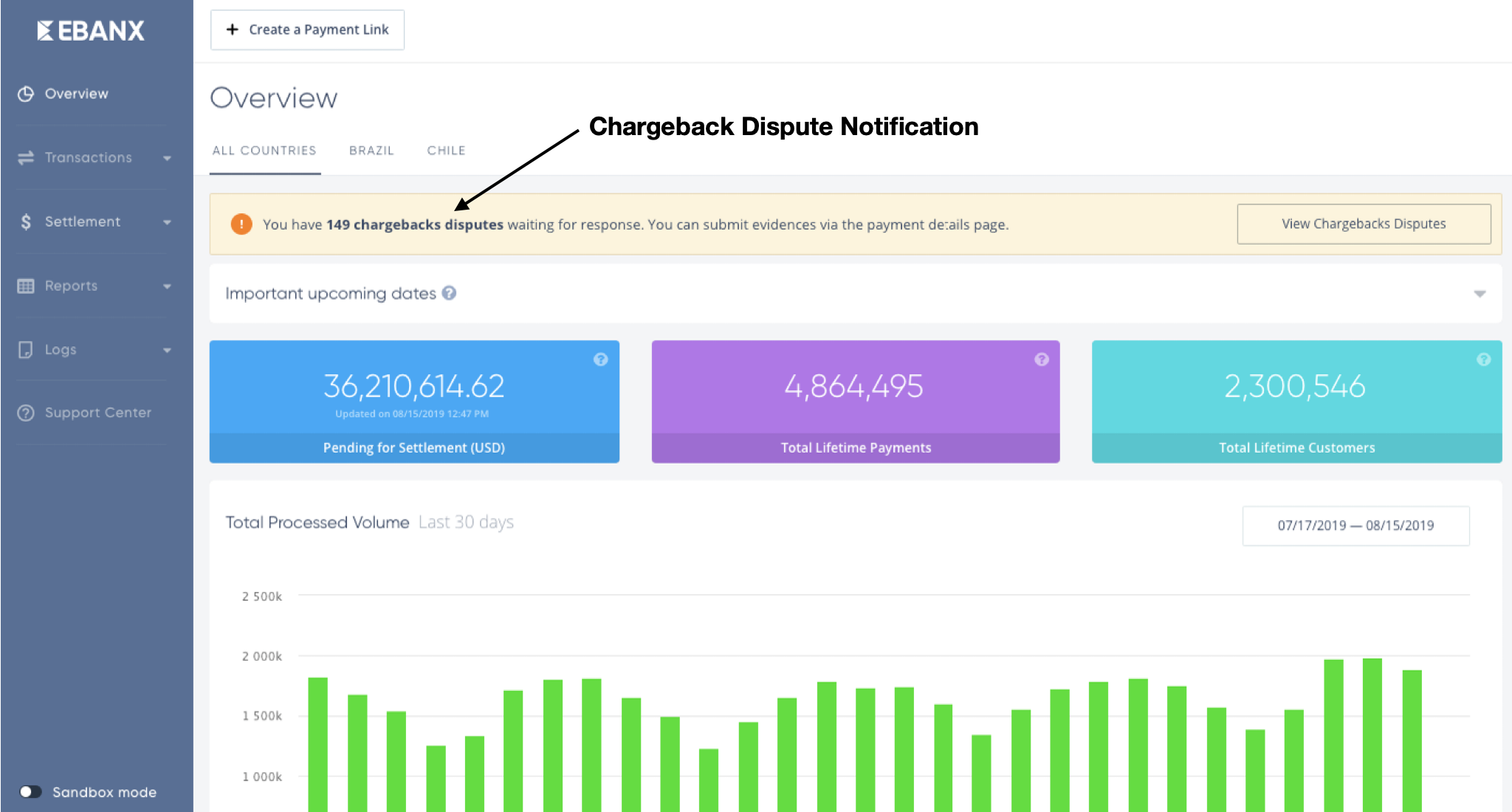

Overview page

A banner will appear on the Overview page of the EBANX dashboard, highlighting the number of affected transactions with chargeback disputes.

- The banner ensures that you stay informed and do not lose track of pending disputes requiring your attention.

- Only users with Admin and Customer Service roles will be able to manage disputes on the Dashboard, so it is important to keep users permissions updated.

Overview page - Chargeback dispute banner

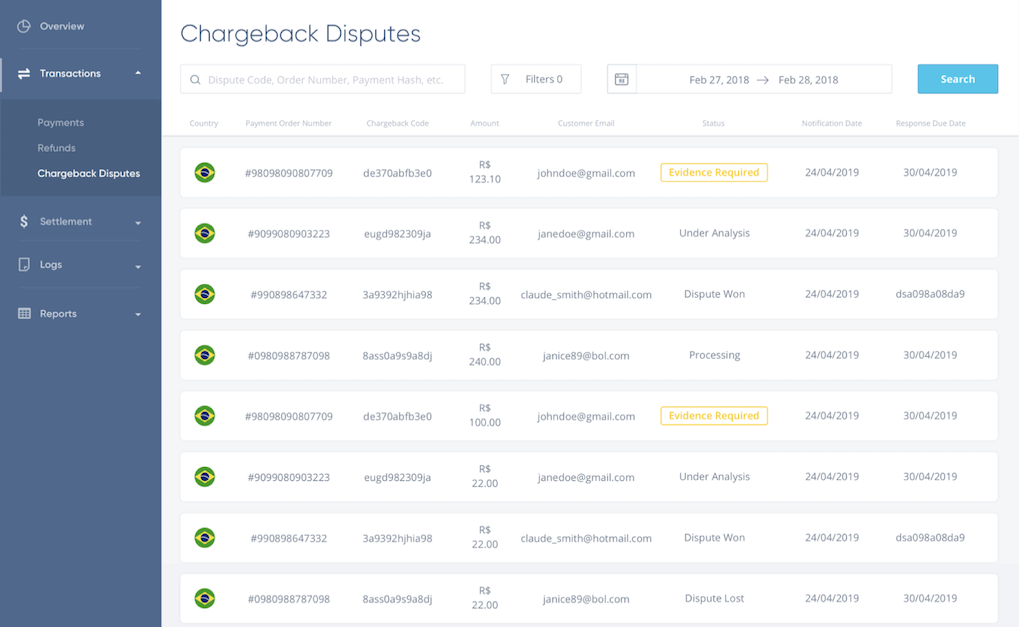

Chargeback disputes page

The Chargeback Disputes page lists all transactions with disputes.

Search filters

To track and manage disputes, use the filters to narrow your search by status. Applying filters helps focus on specific stages of the dispute process and ensures no pending actions are overlooked.

Dispute statuses for search filter

- Processing - EBANX is handling the dispute internally, such as cases of friendly fraud.

- Evidence required - Merchant action is needed to submit evidence.

- Under analysis - Evidence is being reviewed by the issuing bank. This process can take up to 120 days.

- Dispute won - The dispute was resolved in your favor, and the chargeback amount will be credited to your settlement.

- Dispute lost - The dispute was unsuccessful, and no further actions are required.

- Not disputed - No evidence was submitted before the deadline, or the chargeback is considered valid.

Evidence submission

- Pay attention to the status Evidence Required, and the Respond until date.

- You must upload evidence before the deadline, otherwise your dispute will expire.

- By clicking on a dispute that requires evidence, you will be redirected to the payment page to submit evidence.

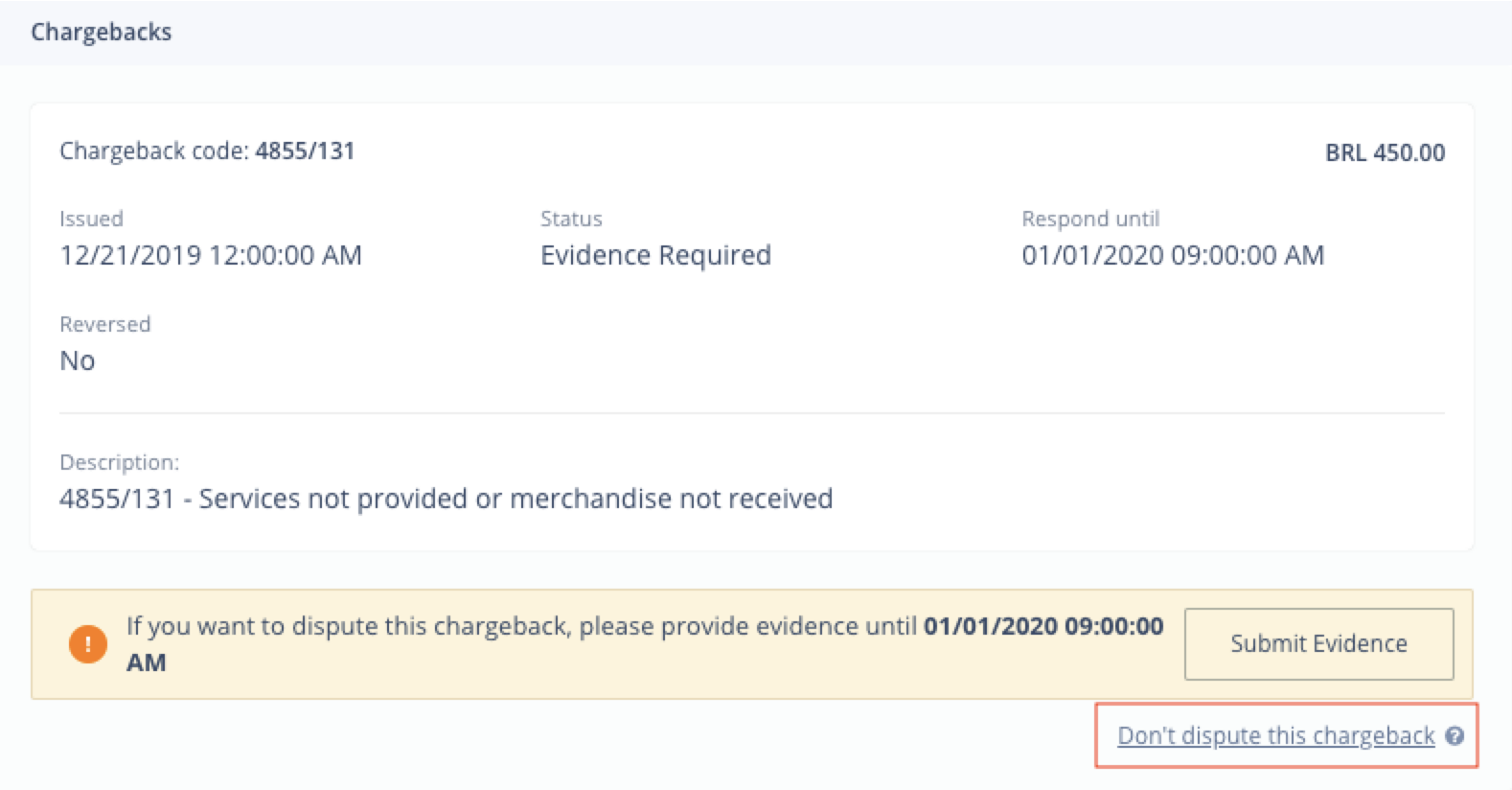

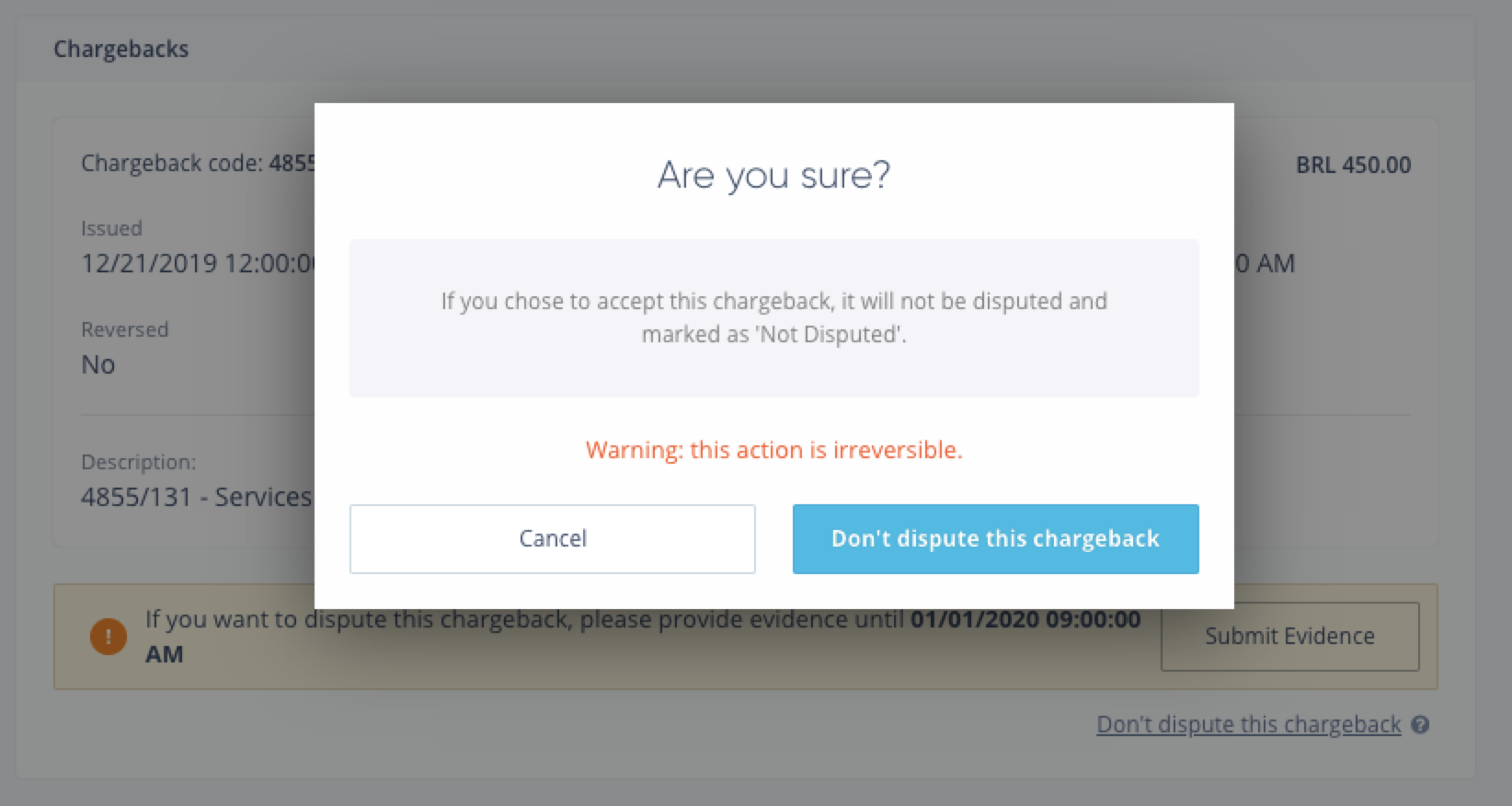

Accepting chargebacks

- If the cardholder and the merchant agree on the validity of the chargeback, there is no need to initiate a dispute process. In situations where fraud is recognized or a refund has failed and the customer requests a chargeback, the merchant can choose to accept the chargeback. This can help avoid unnecessary disputes and streamline the resolution process.

- Merchants can accept chargebacks by choosing Don’t dispute this Chargeback on the payment page.

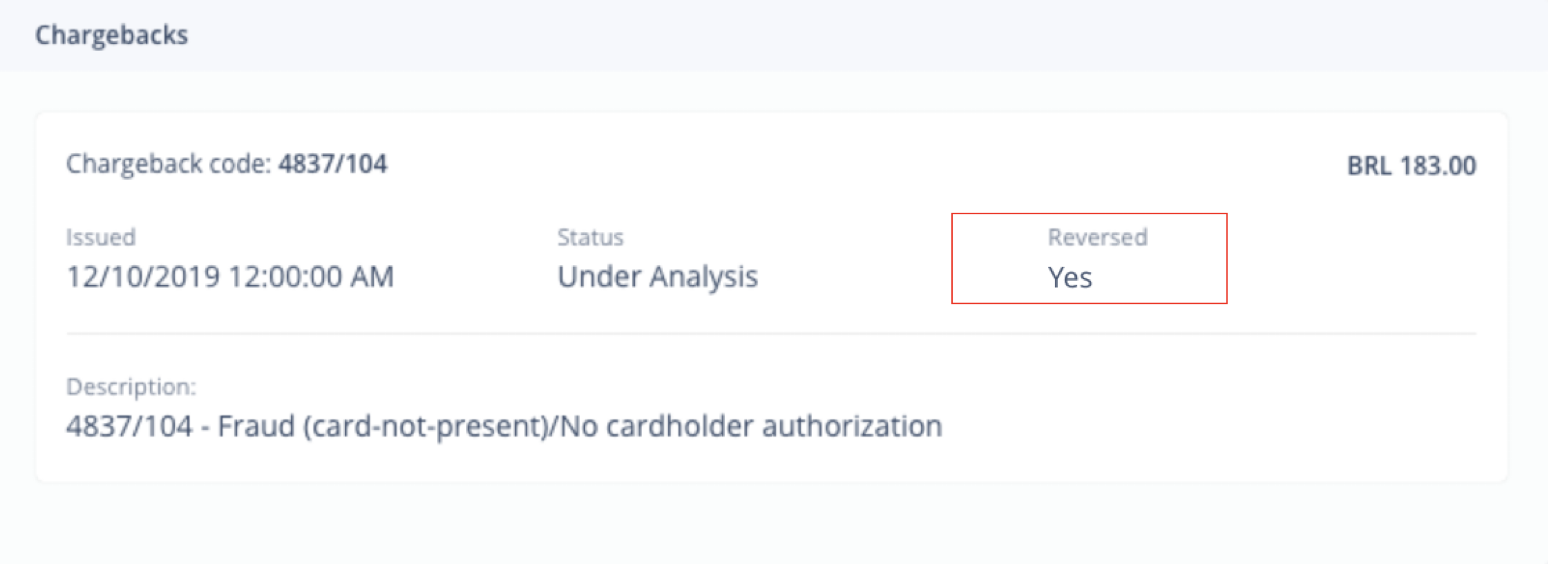

Chargeback reversal

If a customer recognizes the transaction and withdraws the chargeback, it can be reversed through EBANX or the card issuer. Once reversed, the amount will be credited back to your settlement as a Chargeback Credit.

Reversed chargebacks will appear in the Chargeback section of the Payment Page for easy tracking, as shown in the example below.

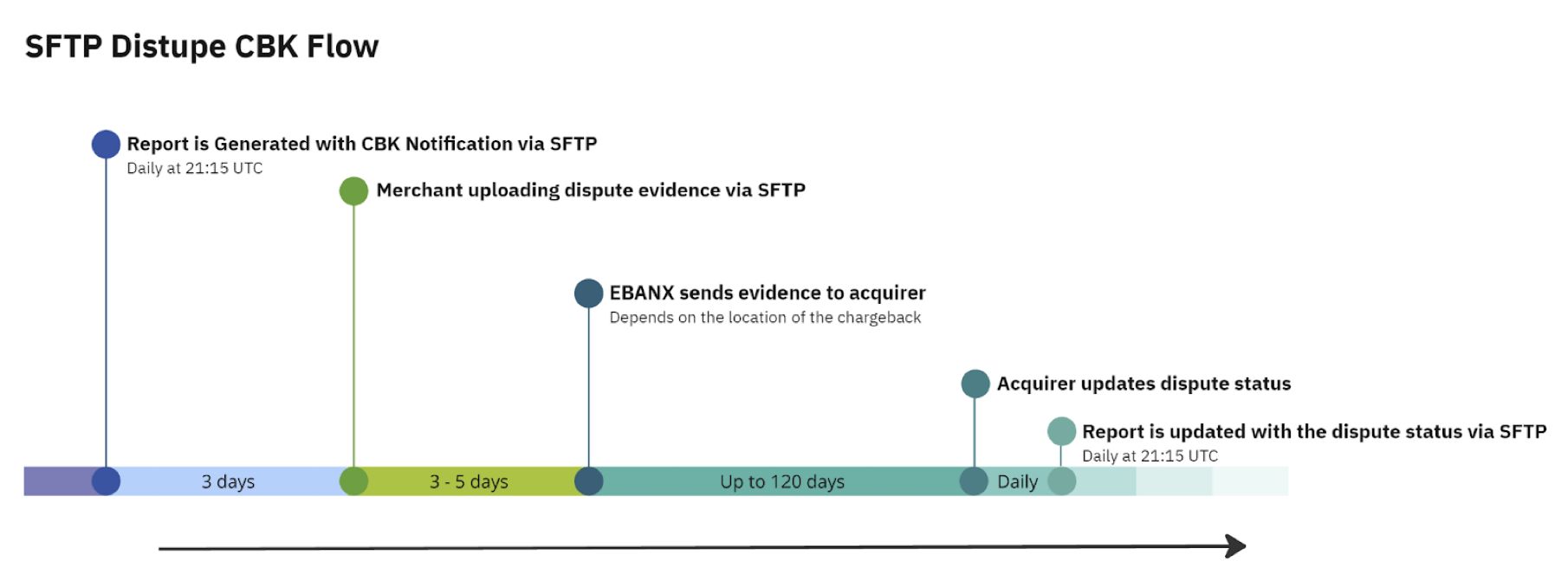

Managing disputes via SFTP

In addition to the EBANX Dashboard, you can manage disputes through an SFTP connection, enabling chargebacks and disputes to be handled efficiently via a file exchange process.

Key features of the SFTP solution include:

Daily chargeback dispute report - The Daily chargeback dispute report is generated daily and provides chargeback details and status updates since the last report. As the same transaction may progress through different statuses over time, it’s important to reference the report to track the latest updates.

Report format

- The report is saved in CSV format and can be found in the

chargeback/notification/directory. - Files are named using the generation date in the format:

cbk_dispute_YYMMDD.csv.

- The report is saved in CSV format and can be found in the

Report contents

This report provides insights into your chargeback management process, ensuring you stay informed and take timely actions.

The daily report includes the following columns:

- Merchant payment code - The code of the payment that originated the chargeback.

- Dispute time - The date and time the chargeback dispute was initiated.

- Currency - The original currency of the payment.

- Payment amount - The amount of the original payment in the original currency.

- Reason - The reason for the chargeback, which could be one of the following:

- Fraudulent

- Unrecognized

- Paid by Other Means

- Processing Error

- General

- Product Not Received

- Credit Not Processed

- Overcharged

- Product Unacceptable

- Representment deadline: The due date for submitting evidence to dispute the chargeback.

- Reason description: Additional details provided by the issuer bank regarding the chargeback.

- Status: The current status of the chargeback or dispute.

- Country: The country where the payment was processed.

Automated evidence submission via SFTP - This solution enables merchants to submit evidence documents in bulk through SFTP, streamlining the dispute process. By automating submissions, it eliminates the need to use the Dashboard, offering a faster, more efficient, and hassle-free approach to managing disputes.

Merchants can submit evidence files for disputes by following this workflow:

Save evidence files

- Upload the evidence files to the

chargeback/evidences_to_dispute/directory via the SFTP connection.

- Upload the evidence files to the

File naming

- The file name must match the Merchant Payment Code, and the file format must be PDF.

- Example:

BDA20030055.pdf

File requirements

- The file must be a single PDF document per dispute.

- The PDF can include both images and text.

- Encryption or zipping is not required.

Automated collection

- EBANX collects evidence files hourly, every day. Once the file is processed, it is automatically deleted from the directory.

Dispute statuses

- Needs response - New chargeback, awaiting merchant action.

- Won - Dispute resolved in favor of the merchant.

- Lost - Dispute resolved against the merchant.

- Not disputed - No evidence submitted before the due date.

Financial flow

- Reversal on Settlement - Chargeback reversals credit the retained amount to the merchant's settlement once resolved.

Frequently asked questions

- Response timelines

- Merchants have 5 business days to respond.

- Banks may take up to 120 days for final resolution.

- Differences per acquirer - Behavior may vary by market and acquirer, including 3DS and fraud prevention rules.

- Auto disputes - EBANX does not perform automatic disputes for merchants.

Still need help?

We hope this article was helpful. If you still have questions, you can explore the following options:

- Merchant support: Contact our support team at sales.engineering@ebanx.com for assistance.

- Not a partner yet? Please complete the Merchant Signup Form, and our commercial team will reach out to you.