Payouts

EBANX Payouts provides a solution for merchants to send payments to partners, suppliers, contractors, influencers, or vendors in emerging markets. It simplifies local and cross-border transactions, allowing businesses to manage payouts efficiently while EBANX handles the complexities behind the scenes.

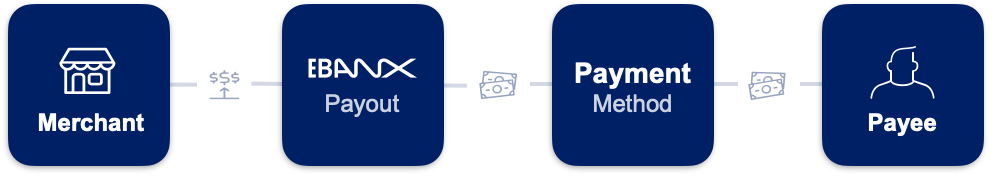

How it works

Here’s a quick overview of the payout process:

Fund your merchant account

Add funds to your EBANX merchant account (takes ~2 business days).Submit payee details for EBANX Payout

Provide the payee’s name, email, tax id and bank info to initiate payment.EBANX processes payment method

EBANX sends instant and fast payouts to bank accounts and wallets.Payee receives funds

The payee gets the money in their account:- Local payouts require local currency funding and a local entity.

- Cross-border payouts (e.g., US to Brazil) use USD, with EBANX converting to local currency—no local entity needed.

Key features

Discover the core capabilities that make EBANX Payouts a powerful solution for managing payments:

| Feature | Description |

|---|---|

| Instant & Scalable Payouts | Supports fast payouts, with SLAs of 2 business days for bank transfers and as little as 2 minutes for e-wallets. |

| Local & Cross-Border Support | - Local Payouts: Merchants add funds in the local currency, and payees must have a local entity. - Cross-Border Payouts: Merchants can add funds in USD, and EBANX converts them to the payee’s local currency—no local entity required. |

| Wide Range of Payment Methods | Includes bank transfers (instant or fast to all banks in supported countries) and e-wallets, tailored to local preferences. |

| Minimal Data Requirements | Only basic payee information is needed (name, email, tax ID, bank details, and amount) to process payouts securely. |

| Integration Options | Offers both code-free and fully automated integration, allowing merchants to choose the best fit for their needs. |

Benefits of payouts

See how EBANX Payouts addresses common challenges to make payments in emerging markets easier:

Regulatory Compliance

EBANX ensures payouts meet local requirements with deep market expertise.Cost Efficiency

Lowers costs of complex, high-frequency transactions via a local network.Speed

Ensures timely payouts, eliminating frustrating delays.Local Knowledge Gaps

Offers access to suitable payment methods in each country through one connection.Information and Prioritization

Simplifies collecting payout data and prioritizing resources efficiently.

Are you ready to get started?

To continue integrating Payouts, please refer to the following: